Leveraging AI to refine your Ideal Customer Profile & Buyer Personas

Your data + AI can help you analyze and refine your definitions for more effective execution

Hi friends - I skipped an issue last week because I was celebrating my baby shower and my first Mother’s Day. In case you missed it, I am due with my first - a baby boy - in July. 👼

Happy belated Mother’s Day to all the moms out there and all the people in their lives supporting them. ❤️

We’re in the middle of a M-AI theme right now (May focused on AI 🤓 ).

We started this series off with How to leverage AI to write your case studies (better and faster).

This week we’ll focus on how to leverage AI to analyze and refine your Ideal Customer Profile and Buyer Personas.

Leveraging AI to refine your Ideal Customer Profile & Buyer Personas

Defining the core elements of GTM

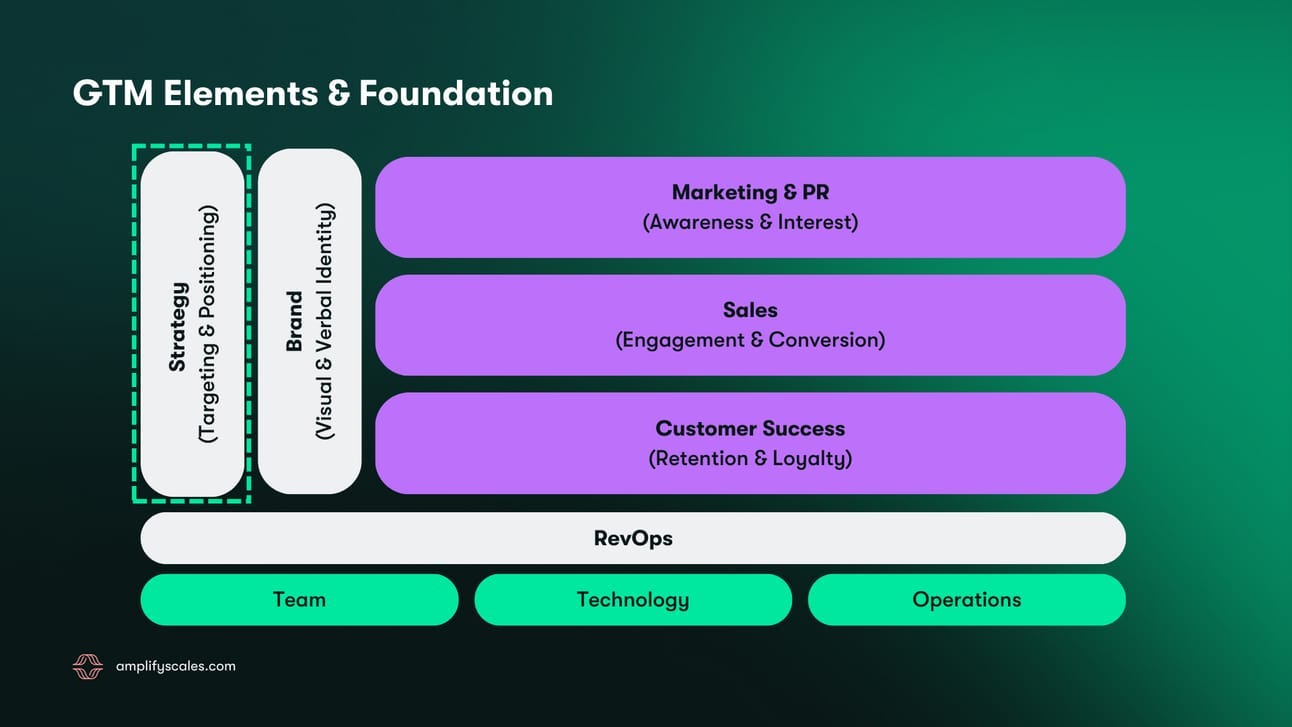

First let’s talk about where your ICP and buyer personas fit within your broader GTM strategy and framework.

This is a diagram I often show clients to help depict the core GTM elements at the highest level -

Starting in the far upper left quadrant -

Once we have clarity on our strategy + our brand, we can effectively and consistently execute across our marketing, sales, and customer success efforts.

All of this is then ideally supported by strong revenue operations so that we can measure and manage our efforts and effectiveness.

How AI can help you analyze and refine your ICP & buyer personas

Our ICP and buyer personas are critical elements of our GTM Strategy (Targeting) - the tip of the GTM spear.

Every founder I’ve ever met has an idea* who they can or should be targeting. But very often, their definition is too big and too broad (for their maturity/stage). And I’m sure you’ve all heard the saying…”You can’t boil the ocean”.

We can use AI to help us both analyze and further refine our ICP and buyer persona definitions to improve our effectiveness ($$).

ℹ️ Note: For this exercise to be as effective as possible, make sure you set up your GTM project in the AI platform of your choice first (detailed instructions in this article).

Action

Example Prompt(s)

Export your current client list from your CRM (including the company name and website at a minimum but more information can only help)

I would describe our ideal customer profile as [insert current description].

Attached is a list of our current customers.

Analyze this list of customers vs the ICP definition I provided above.

Is our customer base reflective of my definition? If not - how is our customer base different from my definition?

What trends do you notice amongst our customer base? Cite trends in terms of industry, size, geo location, age, etc.

How can we further refine our ICP definition to more accurately target companies that reflect the attributes of our current customers?

Export a list of decision makers or champions at those customers (including their name, title, company, and LinkedIn profile URL at a minimum)

I would describe our typical buyer persona as [insert current description].

Attached is a list of our key decision makers or champions from our current active customers.

Analyze this list of people vs the buyer persona definition I provided above.

Do these people match the profile I provided? If not - how are their titles, backgrounds, etc different than I expected?

What trends do you notice amongst our decision makers and champions? Cite trends in terms of their title, length of time at the company, prior roles or types of companies they worked at prior to their current org, education level, etc.

How can we more accurately describe our buyer persona based on this information for more effective prospecting and increased deal velocity?

Export a list of the current companies in your sales pipeline (not customers yet, but prospective customers where there are active opportunities or deals)

Attached is a list of companies that we have open deals with in our sales pipeline.

Analyze how closely these company’s profiles align with our ICP and existing customer base and rank them from best fit to worst fit.

What trends do you notice amongst the companies in our pipeline? Cite trends in terms of industry, size, location, age, etc.

Export a list of companies where you had closed lost* deals

Attached is a list of companies where we lost the sales opportunity - they did not convert to customers.

Analyze how closely these company’s profiles align with our ICP and existing customer base and rank them from best fit to worst fit.

What trends do you notice amongst the companies in our pipeline? Cite trends in terms of industry, size, location, age, etc.

These ^ are the artifacts and questions I always ask my customers (and myself) when I am assessing and developing their GTM strategy…AI just makes the analysis and synthesis 10x faster for me now.

Pro Tip: If your company has less than $5mm ARR and you don’t feel at least a little FOMO when you look at your ICP definition…it’s not niche enough.

The more narrow you can focus your targeting at the beginning, the better. Salesforce is selling to 10+ verticals because they are SALESFORCE. You are not.

Start as niche as possible and expand your ICP (either horizontally or vertically) proportionately as you gain more traction in terms of revenue, funding, and therefore - resources.

See ya next week!

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

Want to learn more about how I help startups increase their revenue by 150-590%? 👀

Know someone who could benefit from being added to this distribution? Send them here to sign up!

With love and gratitude,

Jess Schultz

Founder & CEO

Amplify Group