Bullseye, baby - How to properly define your ICP

Targeting (and positioning) are the core components that should direct your ENTIRE go-to-market strategy.

This month we're going to focus on targeting! 🎯

This is the backbone of everything in GTM. And still, it's something I see poorly defined really often - in companies of all stages and sizes.

Targeting is WHO you are selling to (your ideal customer profile and buyer persona) which is different from HOW you get them to buy (positioning).

Targeting (and positioning) are the core components that should direct your ENTIRE go-to-market strategy. Who we are selling to, and how we're positioning our product in the market should 100% steer the brand (visually and verbally), marketing channels, sales approach, and service model.

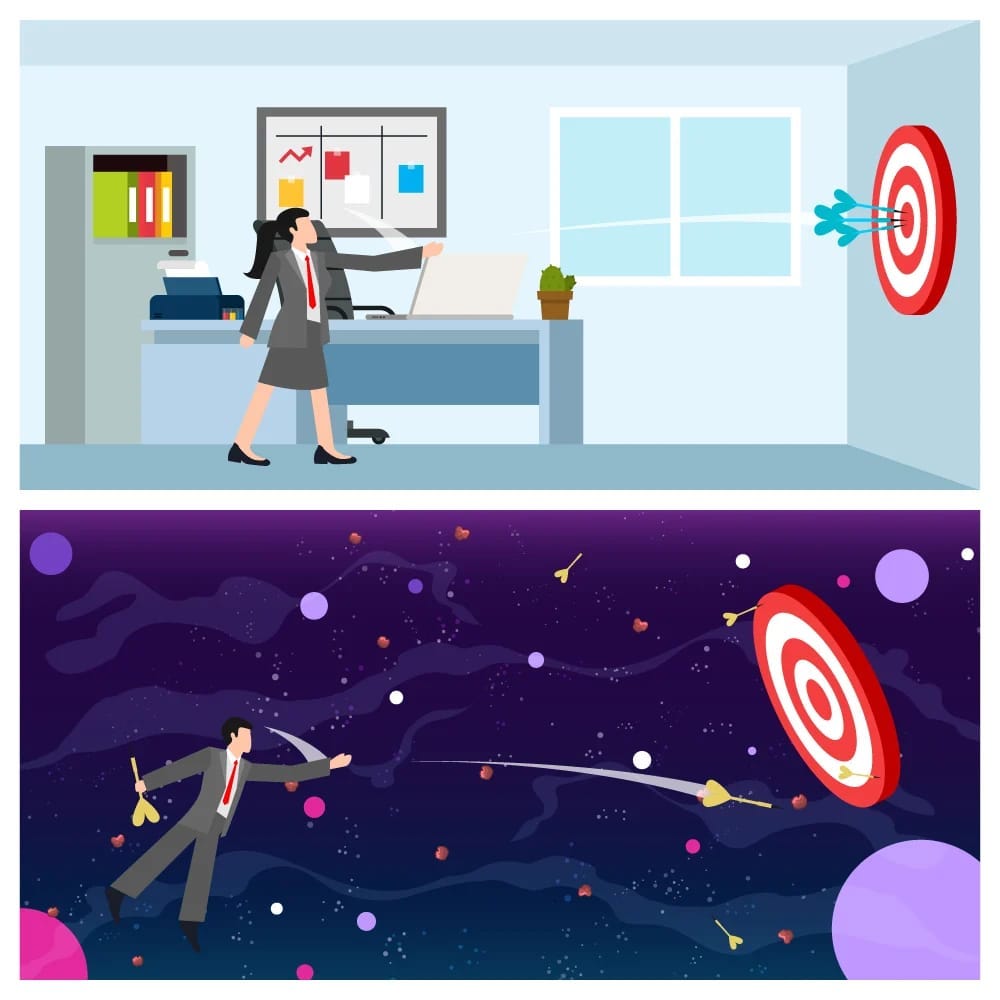

Here is an image I love (and commissioned!) to give you a visual of good versus bad targeting...

And I really want to help you hit the bullseye.

So let's dig in.

Defining your Ideal Customer Profile

This week we're going to break down how to properly define your ideal customer profile (ICP). Your ICP is the characteristic profile of the company you are targeting, which is different from the person within the company (your buyer persona). We'll touch on buyer personas next week.

What does a bad ICP look like?

"We sell to enterprises"

"We sell to SMBs"

"Our solution really helps anyone who needs accounting software"

😑😑😑😑😑

NOPE.

What does a good ICP look like?

In the simplest terms, I like to say your true ICP is the profile of the company who...

Is most likely to buy from you At the highest price point The fastest And see the most demonstrable value (ROI)

Not who could buy from you ever in the entire world....who is the MOST likely to buy from you today, the fastest, at the highest relative price for speed.

A well defined ICP includes core characteristics like -

Geography (either where they are HQ or where they have offices)

Size (defined in terms of revenue or employee headcount)

Industry (perhaps defined using NAICS codes)

Funding (public, private equity backed, etc)

GTM Focus (B2B, B2C, etc)

Additionally, you may define certain triggers within that company profile type that would potentially indicate a greater need for your product.

Things like -

Senior leadership changes in certain roles

Recent funding

M&A

Growth in overall headcount

Growth in a given department headcount (or geographical location)

Open roles for a certain title or department (hiring)

Technographics (the use of certain software internally that you integrate with or complement)

Those ^^ are ALL things you can identify with various tools in the market. I'll touch on tools in greater detail later this month.

What if we can sell to multiple ICPs?

Great. But not all ICPs are created equal. And you can't eat an elephant in one sitting. Aka... you can't target them all simultaneously in an effective manner...especially not as a startup.

You have a small budget, and a small team, and you need to get really specific about who your tier 1, 2 and 3 targets are.

And candidly, who is not a fit for your product at all right now. What would make a prospect disqualified?

This will help your marketing, sales AND product teams. Different client profile's are likely to have different feature and functionality requests, in addition to different buying motivations.

And maybe your product, sales and marketing team is....YOU 😉.But you still need to get clear for yourself + your co-founders and your engineering team resources.

If you are going to target more than one segment at a time anyway, I'd encourage you to define a % of time and budget you are going to dedicate to testing each of these shortlisted targets to create clarity and alignment (70% on X and 30% on Y target).

Your ICP can and should evolve overtime

You can't sell to everyone at the same time at the beginning...but overtime as you have more success, more revenue, more funding, and a bigger team...you can redefine or expand your ICP definition.

This could look like...

an initial GTM focus on investment banks,

followed by the expanded focus on all financial service firms,

followed by a new vertical launch for professional services,

and so on.

How and where can you start?

If you already have clients today, I'd start by analyzing that list. Enrich your current client data with all of the attributes I listed above (size, industry, geographical location etc) and look for trends.

Almost always, you will see that 80% are in healthcare, or 60% are on the West Coast, or 90% were founded after 2010. Look for those trends and ask yourself WHY you think that is the case? Why did those clients pick you?

You can also look at the deals you lost. Why did they not pick you?

In sales we call this a 'win/loss analysis' and it's a good practice for many reasons, one of which is ICP definition and refinement.

If you don't have any clients yet, hopefully you have done market research and user surveys or interviews to determine who you think* has the highest propensity to buy your product.

This is your ICP hypothesis that you should be creating to prove or disprove through your initial go-to-market efforts.

Questions? Shoot them over! You've got this!!

With love and gratitude -

If you want to learn more about working with me directly…

For B2B startups I serve as a Fractional GTM executive or advisor. Learn more about-

When you’re ready, let’s connect to discuss your specific growth goals and challenges.

Subscribe for weekly education, ideas, and frameworks

In this newsletter I share the exact tips, playbooks, and GTM multi-vitamins I’ve used to help 30+ B2B startups scale their revenue 150-590% YoY.

Thanks for reading GTM for Startups by Jess! This post is public so feel free to share it.